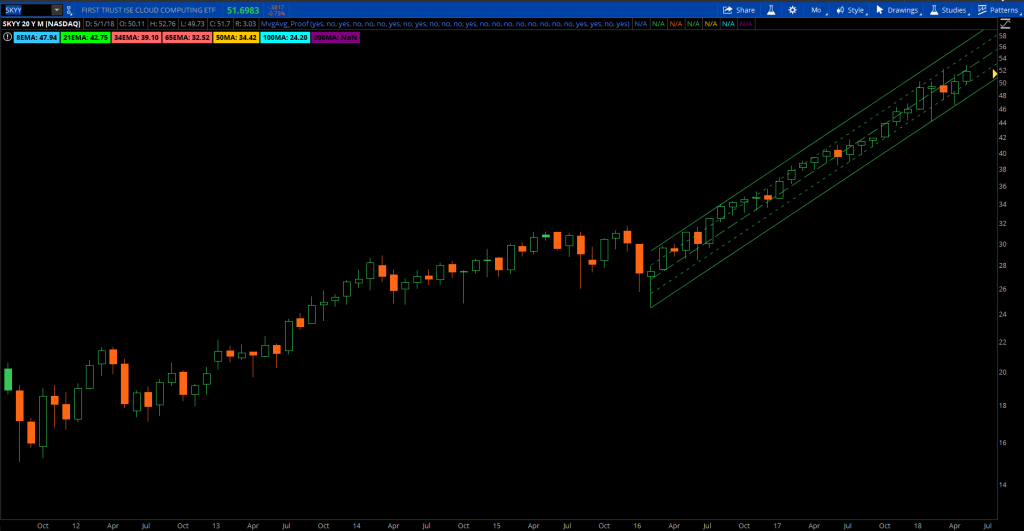

The ETF, SKYY, has some real winners among its 31 holdings, including NFLX and AMZN. While /ES is down 1.1%, and SKYY is down 0.77% today, NFLX and AMZN are both up today. NFLX even hit a new all time high (ATH) today.

Note that today’s drop is largely because of the financial sector, down 3%. The S&P Tech sector is only down 0.92%.

While SKYY has proven to be a great buy and hold, especially if you bought at the beginning of 2016, you have to wonder if you can cherry pick its holdings to build a better cloud portfolio.

Here are the holdings in SKYY as of 2018-May-29. Click on a stock with a link to learn more.

| Security Name | Identifier | Classification | Weighting |

| Netflix, Inc. | NFLX | Internet & Direct Marketing Retail | 7.30% |

| Akamai Technologies, Inc. | AKAM | Internet Software & Services | 5.35% |

| Amazon.com, Inc. | AMZN | Internet & Direct Marketing Retail | 5.34% |

| F5 Networks, Inc. | FFIV | Communications Equipment | 4.88% |

| Red Hat, Inc. | RHT | Software | 4.88% |

| salesforce.com, inc. | CRM | Software | 4.78% |

| NetApp, Inc. | NTAP | Technology Hardware, Storage & Peripherals | 4.54% |

| Cisco Systems, Inc. | CSCO | Communications Equipment | 4.52% |

| VMware, Inc. | VMW | Software | 4.43% |

| Open Text Corporation | OTEX | Software | 4.15% |

| Alphabet Inc. (Class A) | GOOGL | Internet Software & Services | 4.08% |

| Facebook, Inc. (Class A) | FB | Internet Software & Services | 4.07% |

| Teradata Corporation | TDC | IT Services | 3.98% |

| Zynga Inc. | ZNGA | Software | 3.97% |

| SAP SE (ADR) | SAP | Software | 3.92% |

| Juniper Networks, Inc. | JNPR | Communications Equipment | 3.83% |

| Oracle Corporation | ORCL | Software | 3.74% |

| Equinix, Inc. | EQIX | Equity Real Estate Investment Trusts (REITs) | 3.26% |

| Microsoft Corporation | MSFT | Software | 2.55% |

| Hewlett Packard Enterprise Company | HPE | Technology Hardware, Storage & Peripherals | 2.43% |

| Apple Inc. | AAPL | Technology Hardware, Storage & Peripherals | 2.39% |

| International Business Machines Corporation | IBM | IT Services | 2.03% |

| Adobe Systems Incorporated | ADBE | Software | 1.40% |

| Intuit Inc. | INTU | Software | 1.31% |

| Activision Blizzard, Inc. | ATVI | Software | 1.19% |

| j2 Global, Inc. | JCOM | Internet Software & Services | 1.18% |

| CA, Inc. | CA | Software | 1.12% |

| Check Point Software Technologies Ltd. | CHKP | Software | 0.97% |

| NetScout Systems, Inc. | NTCT | Communications Equipment | 0.92% |

| Wipro Ltd. (ADR) | WIT | IT Services | 0.89% |

Leave a Reply

You must be logged in to post a comment.